The Ultimate 2025 Guide to the Bond Market and Treasury Yields

If you’ve been hearing a lot about the bond market lately but aren’t entirely sure what all the buzz is about—don’t worry, you’re not alone. In 2025, bonds and treasury yields have taken center stage in financial discussions, and for good reason. From your mortgage rate to the state of the stock market, the bond market touches almost every corner of the economy.

The U.S. bond market is a critical part of the global financial system, valued in the tens of trillions. Whether you’re a seasoned investor or just getting started, understanding how bonds work—and why treasury bond yields matter—can help you make smarter decisions with your money.

This guide will break down the essentials, explain what’s happening in the bond market today, and walk you through important terms like the 10-year treasury yield, basis trade, TLT, and much more. Let’s simplify the complex world of U.S. treasury bonds and get you up to speed in a very human, no-jargon kind of way.

1. What Is the Bond Market?

Let’s start with the basics. The bond market is where investors buy and sell debt securities—aka bonds. When you buy a bond, you’re essentially lending money to the issuer (like the U.S. government or a company), and they agree to pay you back with interest over time.

But what is the bond market really doing behind the scenes? It’s helping governments fund infrastructure, letting companies raise capital, and giving investors a relatively stable source of income. In a volatile world, bonds are often seen as a safer investment compared to stocks.

The U.S. bond market, in particular, is the largest and most liquid in the world. Within it, U.S. Treasury bonds are the crown jewels—backed by the full faith and credit of the federal government. These include everything from short-term T-bills to long-term 30-year treasury bonds.

In 2025, the bond market has gained renewed attention as interest rates shift and inflation becomes a persistent concern. Savvy investors are watching treasury yields closely to figure out where the economy is headed next.

So whether you’re managing a portfolio or just trying to understand why your savings account rate changed, the bond market today is something you can’t afford to ignore.

2. Key Players in the U.S. Bond Market

When it comes to the U.S. bond market, it’s not just Wall Street firms making all the moves. You’ll find a variety of players in the game, each with different goals and impacts.

First, there’s the U.S. government, which issues U.S. Treasury bonds to fund everything from infrastructure to defense. These bonds are sold at auction and then bought and sold on the secondary market by other investors.

Next, you’ve got institutional investors—think pension funds, insurance companies, and mutual funds. These entities buy treasury bonds for their perceived safety and stable returns. Then there are central banks around the world, which hold U.S. Treasury bond yields as part of their reserves.

Retail investors (like you and me) are becoming more active thanks to ETFs like TLT, which tracks long-dated treasuries, including the 30-year treasury yield. It’s now easier than ever to gain exposure to government bonds without needing to buy them directly.

And let’s not forget the Federal Reserve, a major market mover. When the Fed raises or lowers interest rates, it impacts bond yields instantly. For instance, if rates go up, newly issued bonds pay more, so older ones become less attractive, pushing their prices down.

In 2025, with a heightened focus on inflation and slowing economic growth, these players are moving cautiously. Their actions are shaping everything from the 10-year treasury to basis trade strategies used by hedge funds.

3. US Treasury Bonds: The Backbone of the Market

U.S. Treasury bonds are often referred to as “risk-free” investments—mainly because the government has never defaulted on its debt. These bonds are considered the safest form of debt, making them extremely popular, especially in uncertain economic times.

There are different types of Treasury securities:

- T-Bills (short-term, up to 1 year)

- T-Notes (2 to 10 years)

- T-Bonds (long-term, 20 to 30 years)

Each of these plays a role, but the 10-year treasury and 30-year treasury yield are the ones that get the most attention. Why? Because they’re benchmarks for everything from mortgage rates to business loans.

When the government issues these bonds, they offer a fixed interest rate (called a coupon). The market then determines their value based on current economic conditions and interest rate expectations. As demand rises, bond prices go up—and yields go down, and vice versa.

In 2025, U.S. treasury bond yields have become a hot topic due to shifting monetary policy. Investors are watching yields move daily, as even a small change can ripple across the economy. The 10-year yield, in particular, is being scrutinized as a signal of recession risks and inflation trends.

Whether you’re a retiree looking for steady income or a trader betting on interest rate movements, understanding how treasury bonds work is essential in today’s market.

4. The 10-Year Treasury Yield: The Market’s Favorite Indicator

Among all government bonds, the 10-year treasury yield holds a special place. It’s not just a number—it’s a reflection of where investors think the economy is headed.

The 10-year treasury serves as a benchmark for countless other interest rates, including mortgages, auto loans, and even student loans. When the 10-year yield rises, borrowing costs typically increase. When it falls, borrowing becomes cheaper.

So, what drives this yield up or down? Several factors, including inflation expectations, Federal Reserve policy, and demand for safe-haven assets. In 2025, with inflation proving stickier than expected, yields have been on a rollercoaster ride.

Analysts and traders use the US 10-year treasury yield as a compass for market sentiment. Rising yields can signal optimism about economic growth—or fears about inflation. Falling yields may indicate a flight to safety or expectations of slowing growth.

Interestingly, even news headlines and geopolitical risks can impact the 10-year treasury yield almost instantly. For example, if there’s turmoil in global markets, investors might rush into US bonds, driving prices up and yields down.

Understanding this yield is crucial, even for everyday consumers. If you’re planning to buy a home or refinance a loan, changes in the 10-year yield can directly affect your interest rate.

5. Understanding Treasury Yields and Why They Matter

Let’s zoom out a bit and talk about treasury yields in general. A “yield” is just the return you get on a bond, expressed as a percentage. If a treasury bond pays $50 a year on a $1,000 investment, the yield is 5%.

But here’s where it gets interesting: yields move in the opposite direction of bond prices. When people rush to buy bonds, prices go up and yields go down. When they sell, prices fall and yields rise.

In 2025, yields have been fluctuating due to inflation fears, changing interest rate expectations, and global uncertainty. Short-term yields have spiked, while long-term ones like the 30-year treasury yield have remained more stable. This has even led to moments of yield curve inversion, which some see as a sign of recession.

Why should you care? Because bond yields influence nearly every part of the economy. They guide how banks lend money, how corporations raise funds, and even how governments plan budgets.

In short, treasury yields are more than numbers—they’re signals. And if you learn how to read those signals, you can stay one step ahead of market trends.

6. The 30-Year Treasury Yield and Long-Term Confidence

The 30-year treasury yield is like the elder statesman of the bond world. While most people pay attention to the 10-year, the 30-year tells us a lot about the market’s long-term view of inflation, interest rates, and economic stability.

When the 30-year yield is rising, it can signal that investors expect stronger growth and possibly higher inflation over time. Conversely, when it drops, it often suggests pessimism about long-term prospects or a belief that inflation will cool off. In 2025, this yield is a key focus for long-term investors, especially pension funds and insurance companies that need predictable returns for decades into the future.

This longer-duration bond also tends to be more volatile because small changes in interest rate expectations have a bigger impact on longer timeframes. For example, a half-percent change in the expected inflation rate over 30 years can drastically affect the value of a U.S. Treasury bond in this category.

Another reason people monitor the 30-year treasury is its role in signaling market sentiment. If the 10-year treasury yield is higher than the 30-year, that’s a major red flag. It suggests short-term risk is being priced higher than long-term, an unusual and often troubling sign that could indicate a looming recession.

Understanding the 30-year yield gives you a bird’s eye view of economic expectations. It’s not just for professionals—if you’re planning a mortgage refinance or looking at long-term investments, this yield matters to you too.

7. Bond Yields vs. Bond Prices: The Inverse Relationship Explained

This is one of the most confusing concepts for beginners, but it’s absolutely essential: bond prices and yields move in opposite directions.

Here’s a simple breakdown:

- When bond yields go up, bond prices go down.

- When yields go down, prices go up.

Why does this happen? Suppose you buy a bond that pays 4% interest. If new bonds start offering 5%, your 4% bond isn’t as attractive anymore. So, the price of your bond drops in the market to make its yield competitive.

In 2025, rising treasury bond yields have led to a drop in bond prices across many portfolios. Investors who bought into bonds during lower-yield periods are now sitting on paper losses. That’s why it’s crucial to understand this inverse relationship before jumping into the bond market.

This also affects bond-focused ETFs like TLT, which holds long-term U.S. Treasury securities. When yields spike, TLT’s price usually drops. For traders, this creates opportunities—but also risks.

Whether you’re managing your 401(k) or just curious about why bond news makes headlines, understanding how bond prices and yields interact can help you avoid mistakes and potentially seize profitable moments.

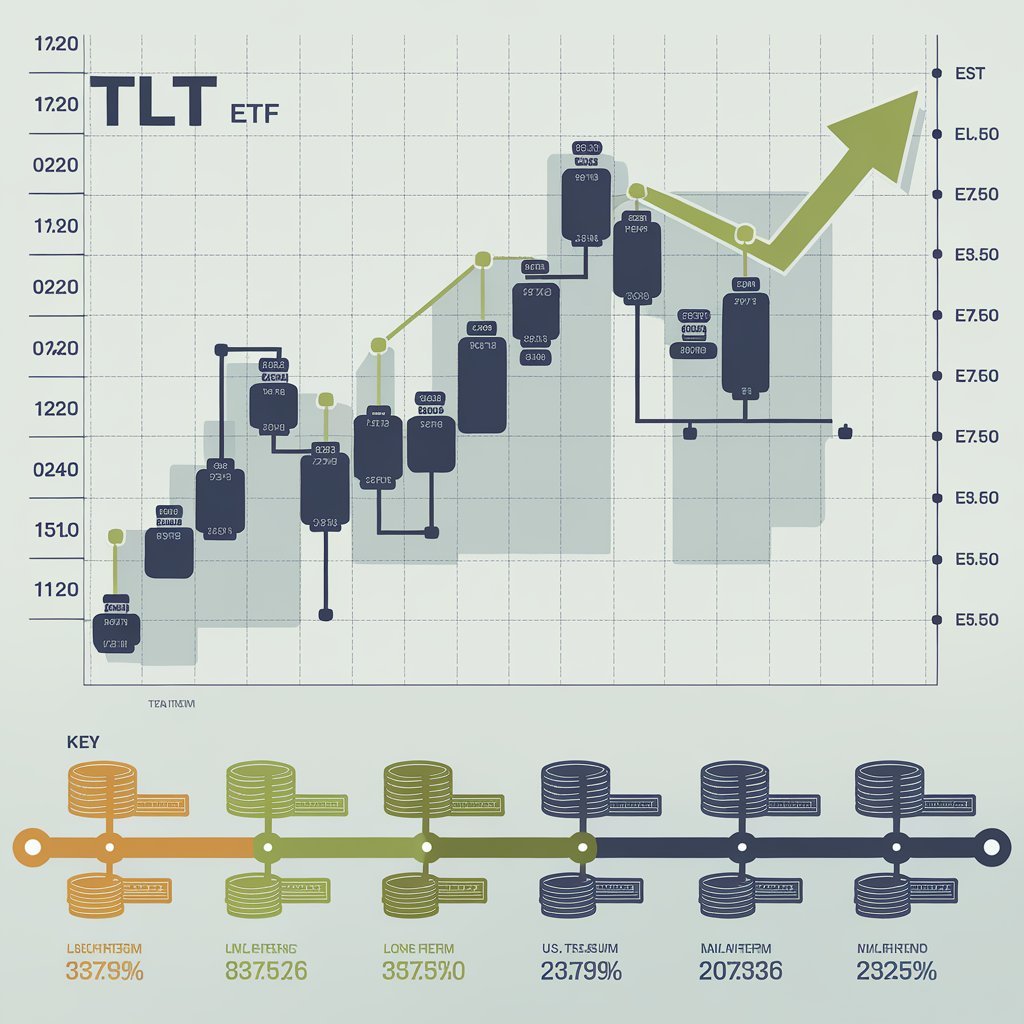

8. What Is TLT and How Does It Work?

If you’ve ever typed “treasury bonds” into a trading app, you’ve likely come across TLT. It’s one of the most popular bond ETFs and a go-to for those wanting exposure to U.S. Treasury bonds—especially long-term ones.

TLT stands for the iShares 20+ Year Treasury Bond ETF. It tracks an index of U.S. Treasury bonds that mature in 20 years or more, essentially giving investors exposure to the 30-year treasury yield without having to buy individual bonds.

This ETF is widely used for hedging, trading, and long-term investing. When U.S. treasury bond yields fall, TLT’s price usually goes up, and vice versa. It’s a direct play on interest rate movements and a reflection of how the bond market today feels about the future.

Many investors use TLT as a counterbalance to stocks. When equities crash, treasury bonds often rise, making TLT a potential “safe haven” during volatility. That said, in rising rate environments like early 2025, TLT can suffer major losses—so timing is everything.

For passive investors, TLT offers simplicity and liquidity. You don’t need to manage bond maturities or reinvest coupons—it’s all handled for you. Just be aware: bond ETFs don’t hold bonds to maturity, so you’ll see price fluctuations based on the broader bond yields.

If you want to play the bond game without diving deep into fixed-income mechanics, TLT is a strong tool in your financial toolbox.

9. The Basis Trade: A Strategy Behind the Scenes

Let’s peek behind the curtain a bit. One term that’s been floating around a lot lately in bond circles is the basis trade. It sounds technical, but at its core, it’s a bet on small price differences between Treasury bonds and their futures contracts.

Here’s how it works: hedge funds or institutional traders buy a U.S. Treasury bond and simultaneously sell a futures contract for that same bond. The goal? Profit from any mispricing between the two. These discrepancies are usually tiny—fractions of a percent—but when you use leverage, they can add up.

In 2025, basis trades have returned to the spotlight due to shifts in the U.S. bond market and rising yields. However, they’re not without risks. If something goes wrong—like a sudden spike in volatility or a liquidity crunch—the whole strategy can unravel fast, as seen in past market disruptions.

So why does this matter to you, the average investor? Because when basis trades go wrong, they can create ripple effects across the entire financial system. In fact, the Federal Reserve has even monitored them as a potential source of systemic risk.

Understanding strategies like the basis trade offers insight into why the bond market today behaves the way it does. Even if you’re not executing these trades yourself, they help shape prices, liquidity, and market sentiment.

10. Bond Market Today: What’s Moving the Market in 2025

As of 2025, the bond market today is a living, breathing beast shaped by multiple forces—interest rate policy, inflation, geopolitics, and investor psychology.

The US 10-year treasury yield has been one of the most watched indicators, fluctuating with every whisper from the Federal Reserve. Sticky inflation and labor market resilience have made rate cuts slower than expected, keeping bond yields elevated.

At the same time, the 30-year treasury yield remains relatively steady, indicating that long-term inflation expectations are under control. This disconnect between short- and long-term yields has even inverted parts of the yield curve, a classic warning sign for economic slowdowns.

Meanwhile, TLT and other treasury ETFs have seen wild swings. For those holding long bonds, it’s been a challenging ride—but also a potential opportunity as yields reach levels not seen in years.

From basis trades to ETF flows, from Fed guidance to geopolitical shocks, the bond market today is more dynamic than ever. Staying informed about these trends isn’t just for economists or traders—it’s for anyone who wants to make smarter decisions with their savings, investments, or debt.

Conclusion

The bond market may seem complex, but once you understand key elements like treasury yields, 10-year treasury benchmarks, TLT, and investment strategies like the basis trade, it becomes a powerful tool in your financial arsenal.

Whether you’re investing, borrowing, or simply observing the economy, keeping an eye on the US treasury bond yields can provide valuable insight. In 2025, the bond market isn’t just a sideshow—it’s the main event.

FAQs

1. What is the bond market in simple terms?

The bond market is where investors buy and sell debt, mainly through government or corporate bonds. It’s how entities raise money and how investors earn fixed returns.

2. Why is the 10-year treasury yield so important?

It’s a key indicator of economic confidence, influencing everything from mortgage rates to investment decisions.

3. What does TLT represent?

TLT is an ETF that tracks long-term U.S. Treasury bonds, giving easy exposure to movements in bond prices and yields.

4. What’s a basis trade in the bond market?

It’s a strategy where traders exploit price differences between Treasury bonds and their futures contracts.

5. Are bond yields good or bad for the economy?

It depends. Rising yields can mean higher borrowing costs but also suggest economic growth. Falling yields might signal investor caution or recession fears.

Post Comment